Fact: by 2019 mobile banking users will represent 32% of the global adult population.

The question is whether your institution is ready for the shift towards mobile banking?

So far we have noticed that the growth in mobile banking usage has exceeded most of the banks’ expectations. Only a few large national banks are offering great experience to their customers, while the rest are now doing the “catching up” and finally placing mobile banking application development on top of their agendas.

If you are among the latter, this guide is for you. Below are the tips to develop a secure, intuitive and anticipated mobile banking app for your customers.

Understand What Drives The Mobile Banking Usage In The First Place

To get an accurate project cost quote from mobile banking app developers, you’ll need to come up with a list of product specifications first. Or simply speaking – a list of features you’d want for your app. Of course, those features should be based on the actual user demands, rather than your educated guesses.

Forrester recently investigated some of the common behavioral patterns among the mobile banking apps users:

- 87% of respondents use the app to check their bank account balances and 74% to review a recent bank transaction.

- Users, who opted to receive account alerts log into their app two more days per month, compared to those who opted out.

- Yet, 90% of consumers admit that they opted out of receiving notifications as most of them are rather useless.

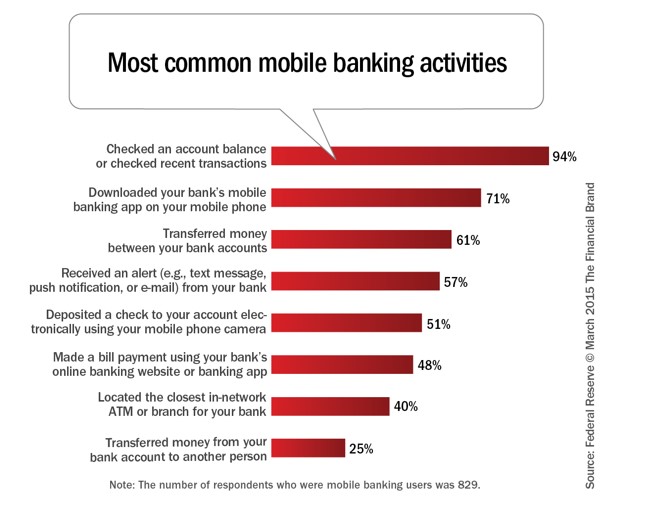

According to another survey conducted by The Financial Brand, you should build a mobile banking app with the following user needs in mind:

In general, before developing a mobile banking app, you should take the time to survey your customer base and narrow down the list of the most requested features. Then rank them regarding priority if your app development budgets are tight.

Settle on The Optimal Mobile Platform

Do you want to develop a banking app for Android or iOS first? That’s the next question you’ll receive from the developers.

Let’s weigh in on the pros and cons of each platform:

- Android’s smartphone market share has hit 2% in Q2 2016. In October 2016 Android has constituted 75.2$ of EU5 smartphone sales, while iOS has accounted for 21.2%.

- Yet, Apple still has more supporters in some of the highest paying markets including Japan (51.7% of smartphone sales), The UK (44%) and the US (40.5%).

Device Atlas has created a great map illustrating, where each platform prevails:

Now, let’s take a look at how the cost to develop a mobile banking application varies depending on the platform:

- To build an Android app, developers should write 40% more code and tend to spend 28% more time working on the project in general.

- The timeline extends mainly due to larger device fragmentation (there are some 1,500+ different Android gadgets on the market right now) and additional product/testing and debugging.

- The app development price may also be higher if you choose to support older Android OS (as users tend to forget to update their gadgets in a timely manner).

iOS app development services usually take less time, especially if you choose to design an iPhone or iPad only app. And most Apple fans tend to keep their gadgets updates to the latest OS, which again reduces the timeline and the costs.

Plan For The Advanced Security

The biggest consumer barriers to m-banking adoption are the security concerns. In fact, 55% of consumers surveyed by Gallup admitted that they avoid using mobile financial solutions as they have doubts about the safety features.

Custom mobile apps for banks should ooze security. However, you’ll also need to strike a balance between those advanced security measures and the product’s usability. Here are a few tips for that:

- You can enable Touch ID authentication to reduce the friction of typing passwords. The feature is also available for new MacBook Pros.

- Log-out users automatically after N-minutes of inactivity.

- Ask users to provide the password only to assess certain functionality (e.g. make a payment), and allow no password access for N minutes to popular features like viewing account balance.

- Urge users to update the app regularly.

- Implement additional security measures and authorization if the user suddenly accesses the app from an unusual location (without prior informing the bank). For instance, send one-time text passwords instead of asking to type in the app pass.

- Always inform them about the important transactions via text/emails.

- Allow users to set limits on payment transfers through the app.

- Clearly state where your official mobile banking app can be downloaded as there were already some 65000 of malicious banking apps reported around the web.

- Do not allow using and installing your apps on rooted devices as that increases the security risks.

If you have the budgets, biometrical authentication is rapidly becoming a new trend in mobile banking app development.

This year TD Bank Group and MasterCard decided to partner with Nymi – an innovative authentication solution provider. Together, they have developed a pilot wearable device that would authenticate payment transactions using the user’s unique heartbeat rate. Their pilot transaction has proved to be successful.

Design a Minimalistic and Attractive UX

The best route to ensure high user adoption is to ensure that your app is easy-to-use. And that seems to be not-so-common with mobile banking apps.

For instance, making a mobile deposit is quite challenging with certain banks:

Here are a few ideas to create a stellar user experience within your app:

- Test, test, test. Before you roll out a new update or a new feature test your product ruthlessly. A few negative comments on the App Store can alienate a large number of users.

- Offer customization based on frequent transactions. Create hotkey access shortcuts and feature the most commonly used features prominently on the main screen.

- Personalization is important. Let users opt-in and out of the notifications/content, they wish to receive.

- Include rich interactions and account for common mobile gestures like pinch, swipe, and rotate movements.

What Are The Mobile Banking App Development Costs?

So, what should you expect to pay for a good-looking and well-functioning mobile banking app?

According to Exicon, 15 of the leading US banks have spent over $80 million on developing some 606 mobile banking apps. That is roughly $132.000 for one business app.

Of course, there are no two same projects and the development costs will vary depending on:

- The platform

- Requested features

- The region you choose to outsource to/local developers’ salaries.

The development timeline, according to Finextra report, is usually between 6 and 12 month (45% of respondents). Yet, 28% of banks manage to deploy an app in less than six months, while 22% need over a year to build a comprehensive solution.

About Author

Slava Bushtruk is CEO+Founder of Alty, Inc. He’s been in software and app development for nearly a decade with over 75 successful projects under his belt, ranging from startups to enterprise clients. You can connect with him on LinkedIn or shoot a quick hi at slava@alterplay.com.